Award-winning PDF software

Cal gov Form: What You Should Know

You will find forms for employment and self-employment. You will find access to Employment Benefits, income tax information, child and income tax forms that will allow you to file your tax return in a timely manner, and you will also find information on filing your EI and IOU claims and other information on Canada's federal and provincial social assistance program forms. Find out what's new and what's available in the latest releases. Enter a description of the work that you performed to prepare these forms and find your file number. In addition, you can quickly navigate to different file types and file your income tax, employment or self-employment tax return online. Filing Your EI and CPP EI and CPP income taxes are collected from workers at regular pay periods, usually the last 10 calendar days of the year. They are deducted from your paychecks by the government. Most employees may be subject to an employment insurance premium, and these premiums are payable to you as you file your tax return. The most common sources of income are wages and salaries and, to a lesser extent, profits from all types of business. You can determine your EI and CPP employment rates on the Employment Insurance and CPP web pages. What type of information should the employer provide in order to qualify for CPP benefits? You must show the employer that all of your earnings are directly related to your employer's business activities. The following can be considered direct and should be disclosed: The business name. The business location. The business telephone number. The business website address. The number of hours for which you or your work is directly related to your employer's business and the number of employees in relation to that. To file your CPP claim, you must enter the information in Question 14 above on any CPP slip that you receive. For more information on CPP, visit the CPP website. Finding your EI and CPP Employer/Employee Information For more information on how EI is calculated, see the Guide to EI Calculations (ESA 1040) : If you are receiving benefits from Ontario Works, you can find your information within the EI Online System. If you need help finding your information online, you can get a list from the CPP online portal.

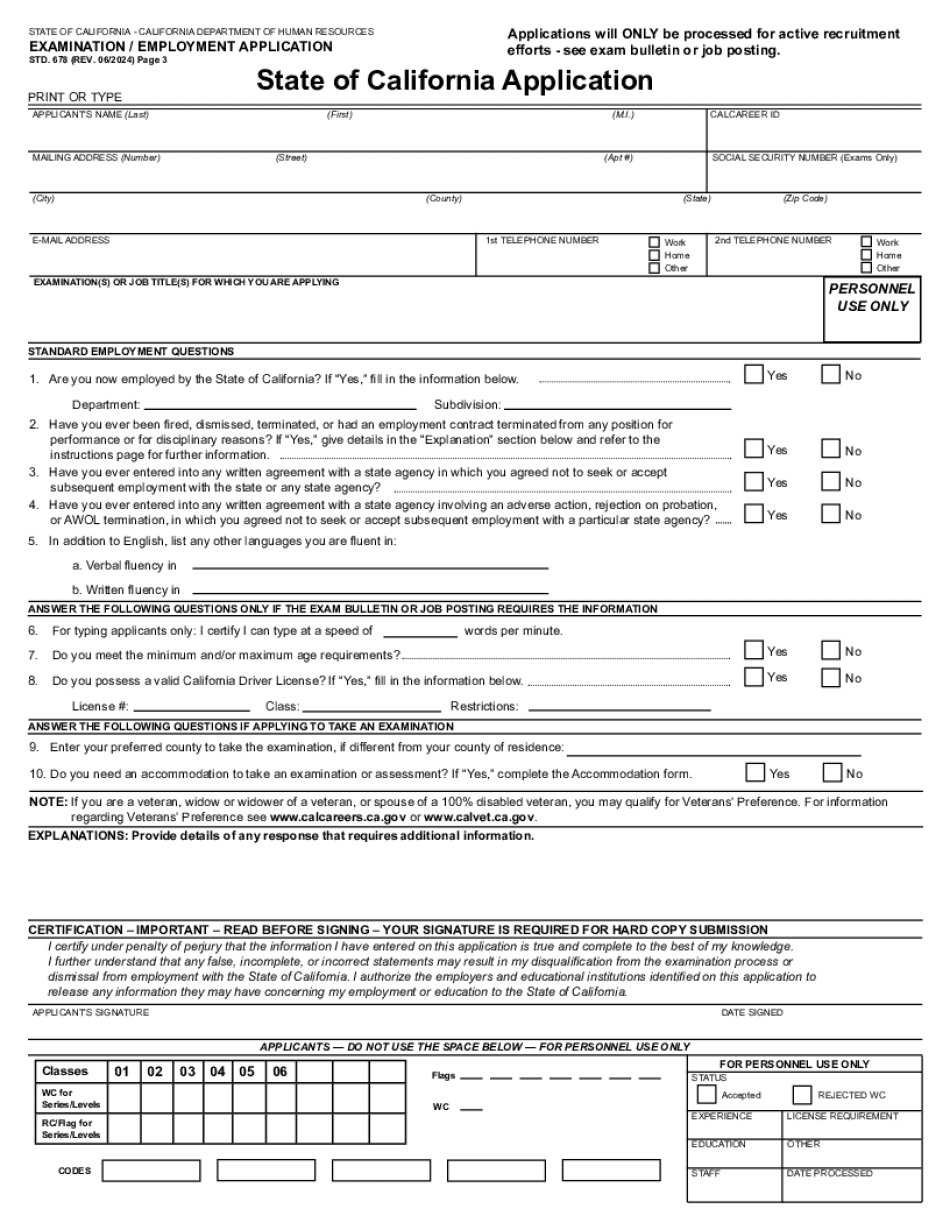

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2013-2025 Ca Std 678, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2013-2025 Ca Std 678 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2013-2025 Ca Std 678 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2013-2025 Ca Std 678 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.