Award-winning PDF software

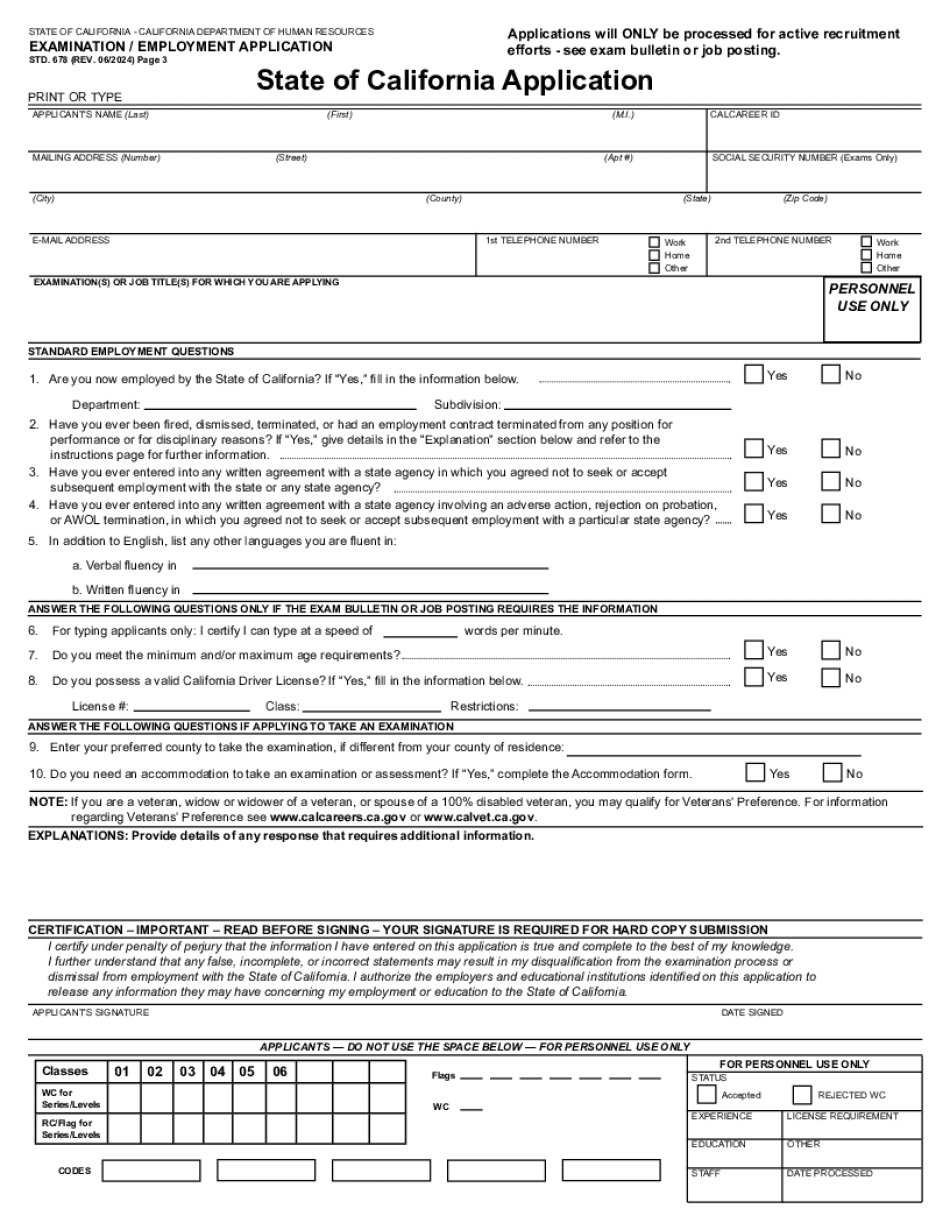

Std 678 fillable PDF Form: What You Should Know

You should include all of your Form 2555 and Form 2555-EZ information in box 2 of Schedule D, Part I, for your federal and state tax returns. Do not use any information from your return. Do not use the Form 2555-EZ if you are claiming the Exclusion for Dependent Care Exclusion for Dependent Care The Exclusion for Dependent Care Exclusion is a tax provision available for US citizens who are their household's dependent caretakers on the date you earned wages and file tax returns. You are considered dependent if you meet certain requirements. This is useful to help you determine whether you must file or pay estimated tax on the wages that you contribute to your dependent care. How To Claim the Exclusion for Dependent Care Your dependent care provider must be: Your dependent care provider must have been physically present in the household for more than half the tax year. This rule applies whether your dependent care provider is a US citizen or an unmarried partner. Your dependent care provider must meet the following requirements. The dependent care provider must be a Citizen. The dependent care provider must not be an unmarried partner for your tax return. The dependent care provider must be residing in or attending the same household as you. US citizens can claim the exclusion for their dependent care providers for up to the tax year, and can count tax paid by them toward the exclusion. The exclusion is subject to a maximum of 10% of eligible compensation. If an exception applies, it will be stated with the exclusion. Form 8332 — Tax on Nonresident Aliens (This information should apply when using the Form 8332 to file the Form 842 on the foreign return.) The Form 8332 is not for American corporations or individuals but provides income tax withholding and payment information for a nonresident aliens in the US. The form is only issued to individuals who don't own a home in the US but have a householder in the US with whom you are involved in an unmarried marriage. Form 8332 — Form and Amount of Tax for Nonresident Aliens US tax return and Form 8332 Form 8332 is required by U.S. Internal Revenue Service regulations to be filed by U.S.-based nonresident aliens that have a partner or householder overseas. The Form 832 must be completed in U.S. dollars and can be completed online (you can send the form back by mail.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2013-2025 Ca Std 678, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2013-2025 Ca Std 678 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2013-2025 Ca Std 678 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2013-2025 Ca Std 678 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.