Award-winning PDF software

Std 686 Form: What You Should Know

The EAR contains instructions for completing the form after your employer accepts your earnings on your behalf (e.g., paycheck or salary). Employee Direct deposit: • Use the Employee Direct Deposit (DR) form provided in this document to submit your earnings as “cash wages” to the employer's designated account (e.g., bank account, SEP account, PayPal account) • If you have never been an employee of the employer and your gross annual earnings are less than 5,000, you will be required to complete the EAR form and to pay federal income tax with interest as provided in the terms and conditions for making an “electronic payment” or “direct deposit” under IRS rules. When you have received and signed up for such a procedure, follow the guidance provided in the Direct Deposit Instruction Guide of the CSU Employee Benefits Handbook () — CSU Note: This guidance applies to those who have never had a direct deposit at this institution. Employee Compensation: • If you are an employee of a non-profit entity, use the Employee Compensation Summary (EPS). The EPS allows you to enter the date, amount of compensation, name, title and employer online “G.” There is a line for the total earnings for the payment period, shown as a percentage of the number of hours “hours” worked: Employee Compensation Summary (EPS) (Explanation) • If you are an associate professor at a state university, use the Executive Summary (EAS). Use the name of the institution online “G″, the address, the date, and your title on the left side and on each of the other two pages. You can enter the date, amount of compensation, name, title, and employer on the left side page (EAS) • If you are an employee of the university, use the Annual Summary (AAS). On AAS: • Enter the date and amount of income each pays online “I.” This line will include some or all of the gross tuition, mandatory enrollment fees, room and board.

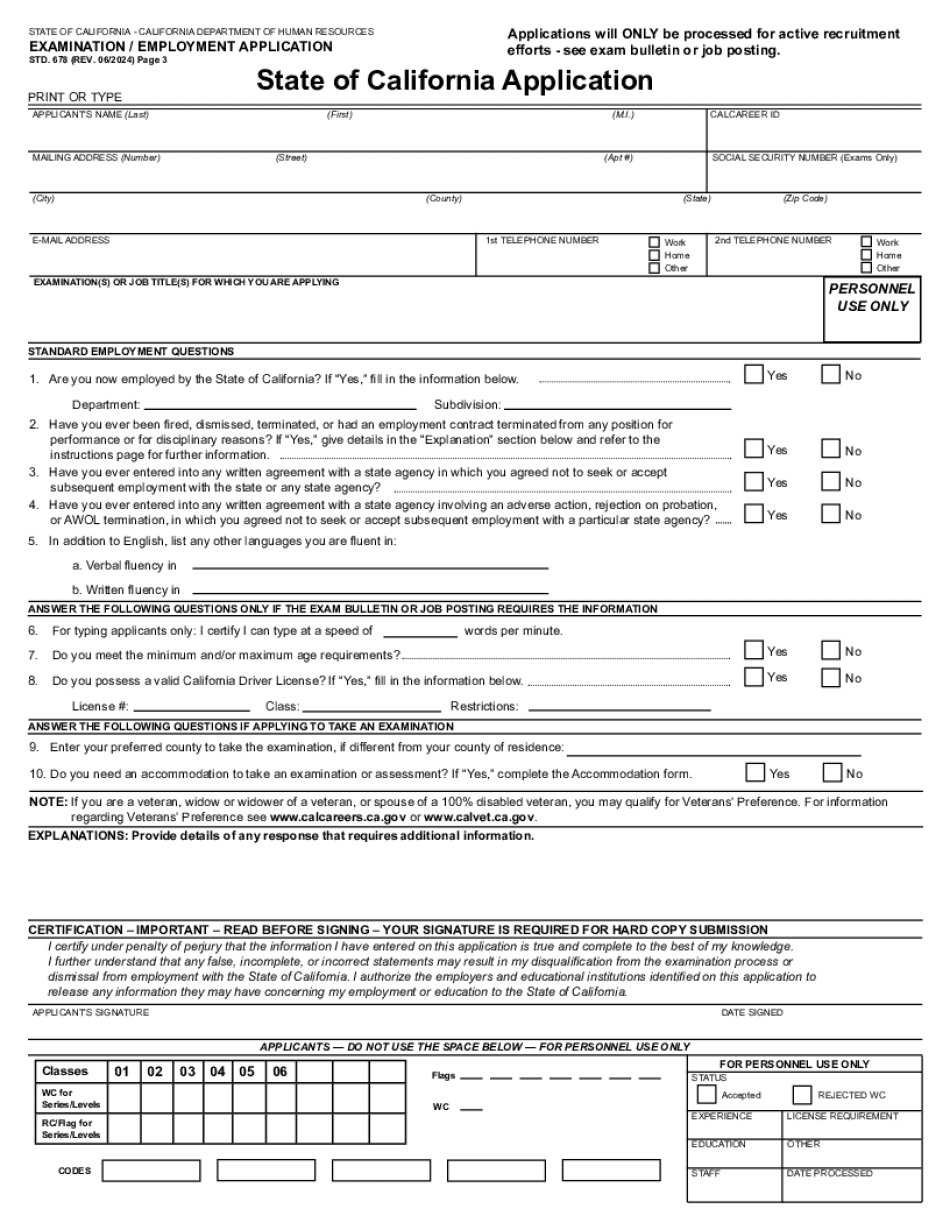

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2013-2025 Ca Std 678, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2013-2025 Ca Std 678 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2013-2025 Ca Std 678 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2013-2025 Ca Std 678 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.